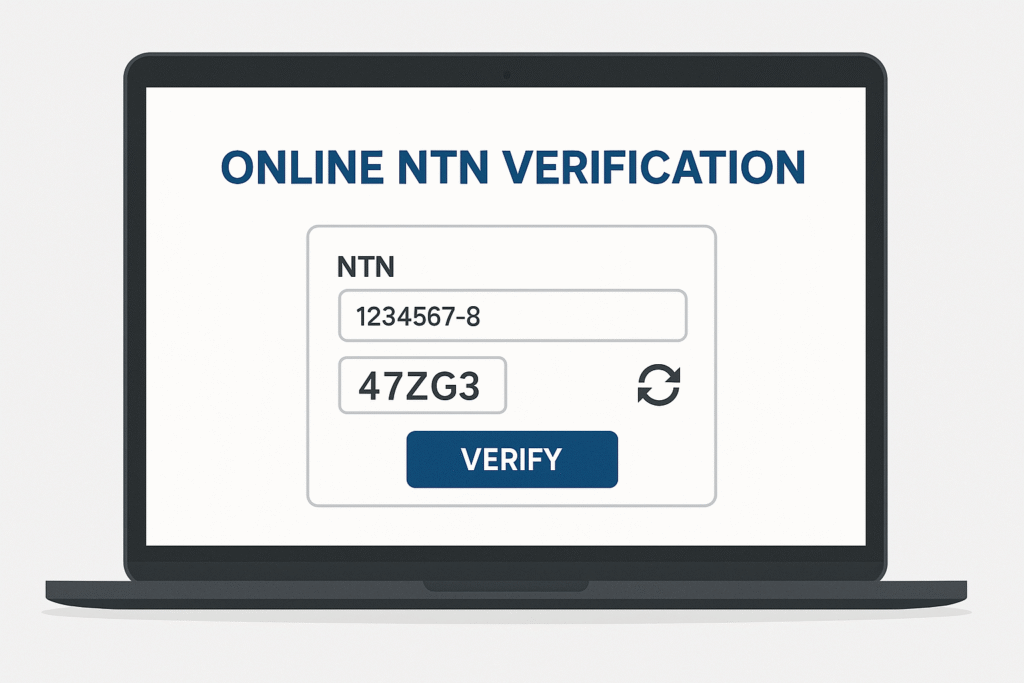

Online NTN Verification in Rawalpindi.

Are you looking for?online NTN verification.

what does NTN Mean?

- NTN stands for (National Tax Number ).

- NTN is a special identification number issued by Federal Board of Reveneu (FBR) to all Pakistani for tax purposes .

- We need NTN for things like import/export etc.

- Types of NTN: Individual NTN (Salaried persons, freelancers, trader), AOP NTN (Associations of Persons (e.g. firms), Company NTN (Private or public limited companies).

/image

Why we need NTN ?

It is commonly used in counties like Pakistan:

- To register as a taxpayer with the government.

- Required for filing income tax returns.

- Needed for various financial activities like Opening a business bank account, Purchasing property or vehicles etc.

- Participating in government tenders. (Government Tenders) are formal offers or invitations issued by government departments or agencies inviting businesses (contractors or suppliers) to bid for providing goods, services or working etc.

- You cannot file your tax return without an NTN or CNIC (Computerized National Identity Card, used as NTN for salaried individuals).

- Registering a company or partnership

- If you’ve overpaid taxes (e.g. withholding tax), having an NTN allows you to adjustments or claim refunds

- Helps the government track income, ensure tax collection, and reduce tax evasion.

- Even if you’re a freelancer, student with income, small business owner, or property buyer — registering for NTN is a smart move.

- Without NTN = Can’t pay income tax properly

- With NTN = Become a registered taxpayer

How to get NTN in Pakistan ?

To get an NTN ( National Tax Number ) in Pakistan, you need to register with Federal Board of Revenue (FBR). The process is mostly online in Pakistan.

we need to preparedocuments like:

- CNIC (Computerized National Identity Card)

- Photo (passport size)

- Mobile number (sim of your name)

- Email address (your own email)

- Proof of address like utility bill or rent aggrement

- work or business details

- Once verified, FBR issues your NTN.

Benifits of NTN:

In Pakistan, obtaining a (National Tax Number) NTN from the Federal Board of Revenue (FBR) has many useful benefits for individuals, businesses, and professionals like :

- Tax rates are lower for filers as compared to non-filers on: cash withdrawals,Utility bills,Car and property purchaces,bank transactions etc.

- Many public sector organizations require an NTN for applying to contracts or tenders

- Having an NTN and filing returns helps maintain a financial track record, which is helpfuland useful for : Leasing, credit cards, loans

- It is also necessary for registering a company or business with regulatory bodies (e.g., SECP, chambers of commerce).

- NTN is needed to open a business bank account or obtain a business loan.

- t shows that your income is legal and declared.

- Helps if you need to show your income source (e.g., for visas, loans, or business dealings)

- Real estate or car transfers require NTN for smooth processing.

- Having an NTN and filing tax returns helps build a taxpayer record.

- If you’re doing business or freelancing, government contracts often require a valid NTN.

- It shows you’re a registered business/taxpayer.

- If you file returns using your NTN, your name is added to the Active Taxpayer List (ATL)

Disadvantages of not having NTN:

- If you don’t have an NTN or don’t file tax returns, the government charges you higher withholding tax on many transactions, such as:

- Filer (NTN holder) = Lower tax

Non-filer (No NTN) = Higher tax - You cannot buy or sell property above a certain value legal.

- FBR may block the transaction if you’re not registered.

- You’ll have to pay higher advance taxes during the process.

Example: Buying a 10 million rupee plot without NTN means a 2–4% higher tax, costing you over Rs. 200,000 extra. - You have to face conditions like: Delays in car registration, Higher token taxes, Difficulty getting a vehicle loan etc.

- Excise departments check NTN or ATL (Active Taxpayer List) status during processing.